Business Start-Up – A Friendly Guide

Many congratulations on your business start-up idea – now the work really begins!

Lets start with a regularly quoted statistic ‘the reason most businesses fail is due to poor financial planning’. We are going to make sure that this is not you through this easy to read blog and Excel templates.

We know even the thought of numbers fills many with dread! Therefore FD Solutions and Accounting are available to answer any of your queries and to assist with your financial and tax returns.

The next sections take you through the various stages of financially planning your start-up business – making sure your business idea is truly financially viable, before you take the plunge.

BUSINESS START-UP EXPENSES

This should be one of the first things you do – even if you discover it is too expensive to start, getting an understanding of costs is important before any financial commitments are made.

It might not be applicable if your business is already started however even then we suggest you complete our spreadsheet including items on hand today (for example cash balances, assets owned etc).

This is one of the few sections of your business plan which won’t be updated (you only start once). Include all expenses involved with starting your business start-up including acquiring a premises, professional insurance, equipment, employee wages and stock/consumables.

If you require funding other than personal savings you’ll need to consider the advantages and disadvantages of each – for example a bank loan could be relatively straightforward but what guarantees are required? Family investment could be another option however would this put strain on relationships at home?

Please email request our accompanying spreadsheet

FINANCIAL PLANNING

The following sections cover vital business start up and ongoing financial planning tools. Once prepared you might require the help of our accountant to explain their meaning or to offer suggestions to keep your business vision on track.

Setting a Sales Price

How do you know how much to sell your products and services for?

This will be decided from market research asking yourself –

-

- How much are your competitors selling a similar product or service?

-

- How does this compare to yours?

-

- Are they offering promotions and packages?

You then need to consider your costs –

-

- What are your direct costs (materials and labour)

-

- How much is it going to cost to produce your product or service?

-

- What are your fixed costs – for example rent, motor vehicles.

Please email request our accompanying spreadsheet

Now you have calculated a selling price you need to decide how customers are going to pay you.

-

- Will it be at point of service

-

- In advance

-

- After the event maybe offering them credit terms

-

- You could consider offering discounts for early payment?

Remember the longer the customer keeps their money the less your business has in its own bank account to use.

Sales Forecast

This is where and when your money is going to come from including plans for growth. It will tell you when you need to employ people or what to do if things do not work out so well.

To complete your sales forecast you need to look back at your vision – how many sales do you need to achieve this?

We suggest you complete at least two sales forecasts – one expected and a second worst case. The worst case then gives time to form a plan should this happen – for example try seeing what happens if you only achieve 50% of year one sales?

Please email request our accompanying spreadsheet

Profit and Loss Projection

This calculates the level of profit you are expecting to produce. It should use the sales totals from your sales forecast combined with the costs directly associated with these sales.

To determine all costs you should consider

-

- Do you need premises to trade from

-

- What purchases (stock to resale/animal feed) do you need to make

-

- Telephone/broadband

-

- Machinery, computer/software licences

-

- Etc

Similar to the sales forecast we suggest you prepare two profit and loss projections – one expected and the other worst case.

Please email request our accompanying spreadsheet

We suggest you prepare a projection for at least five years (then update it on an on-going basis) – as things change so can your projections (for example – win/lose a major client). This is all part of a development plan – development process that develops as your business changes.

This document will be vital if you are applying for a bank loan however even if this is not the case – you need a plan to help fulfil your vision and this is the road map to help you achieve it. We recommend on a monthly basis you look back on these projections and compare them to your actual results – if things have changed update your projections.

For example – if you have not achieved sales targets ask yourself why, is your forecast too unrealistic. What improvement is required for the coming months or is this a permanent?

Cash Flow Forecast

You will no doubt have heard the business comment – cash is king! Never underestimate this, running out of cash (your business life blood) is the most common final reason for business failure – in fact 85% of small businesses start-up fail in the first five years because of cash problems caused by insufficient financial planning – make sure this is not yours!

A cash flow forecast differs to the profit and loss projection as it is based on your business bank balance and when cash is actually received or paid.

This should include

-

- All the cash the business will receive

-

- All the cash the business will pay out

To find this information look at your profit and loss and start up expenses projections. You will need to include cash from any source –

-

- Sales

-

- Money invested by yourself/bank/family etc

-

- Tax refunds

-

- Together with when you are to spend this on, for example

-

- Purchases

-

- Employee wages/your drawings

-

- Motor expenses

-

- Software

-

- Rent

-

- Your accountant!

If you discover your bank account becomes overdrawn you have run out of cash! So time to make alternative plans to prevent this!

Please email request our accompanying spreadsheet

KEEPING FINANCIAL RECORDS

All businesses large or small need to keep financial records both to stay in control of what needs to be paid and to calculate how much tax is owed.

Record keeping does not have to be complex, if you only have a few transactions a spreadsheet should be sufficient.

Please email request our accompanying spreadsheet to get your started.

As your business start up grows there are lots of accounting software packages available some even given free if you hold a business bank account at certain banks. Our recommendation though is Xero Accounting which is cloud based, easily configurable to your business and has many add-ins available (for example banking/payments, ecommerce or time management) in order to adapt as your business grows. It is fast becoming the leading accounting software package used by small/medium sized businesses.

Your will need to register as self employed with HMRC and complete a personal tax return each year. If you are running your business through a company this too needs to register and submit its own tax return – please see the next section for more details.

FINANCIAL YEAR END AND TAXATION

The sort of tax you are liable to pay is dependent on your business structure (for example self employed or a company).

Here is a brief overview of the tax types, how and when to pay them together with sources for additional help.

-

- Corporation Tax – a tax on profits paid by companies

-

- VAT (Value added tax) – a tax on products or services that exceed a turnover of £85,000 a year paid by any applicable business.

-

- Business Rates – a tax on ‘non-domestic properties’ used to run your business paid by the applicable business.

-

- PAYE (pay as you earn) – a tax deducted from salaries paid by any business with employees.

-

- Income Tax – a tax on income (profits) paid by any business

-

- National Insurance – Contributions paid to qualify for a state pension as well as government benefits.

Corporation Tax

Paid by Limited or CIC Companies, clubs, co-operatives and other associates.

This is based on profits and currently at a rate of 19%. From 6th April 2023 this changes to – first £50,000 at 19% and 25% for profits in excess of £250,000. Profits between these amounts will be charged at what is known as a tapered rate equivalent to 26.5%.

Unlike other taxes you will not receive a bill for this. It is up to you to make sure you calculate and submit what you owe to HMRC (or ask for the help of an accountant). You need to apply to the HMRC for a unique tax reference (UTR).

You must always file a company tax return (even if the business makes a loss or does not trade at all).

Filing deadline – 12 months after the end of your accounting period.

Tax payment deadline – 9 months and 1 day after the end of your accounting period. For example – if your company’s year-end is 30th June this will be due on 1st April the following year.

If you are a limited company in your first year of business you may have to file two tax returns. This is because you become incorporated on the day your company is set up but your accounting reference date begins on the last day of the setup month. For example if your company was set up on May 8th, your accounting reference date would not apply until May 31st. Annual accounts cannot cover a period in excess of 12 months two separate returns are necessary to account for the extra 3 weeks.

| You can manage taxes yourself but this can be overwhelming especially keeping up to date with changes in legislation (good and bad for businesses). Accountants can help stay compliant and never miss deadlines! |

VAT

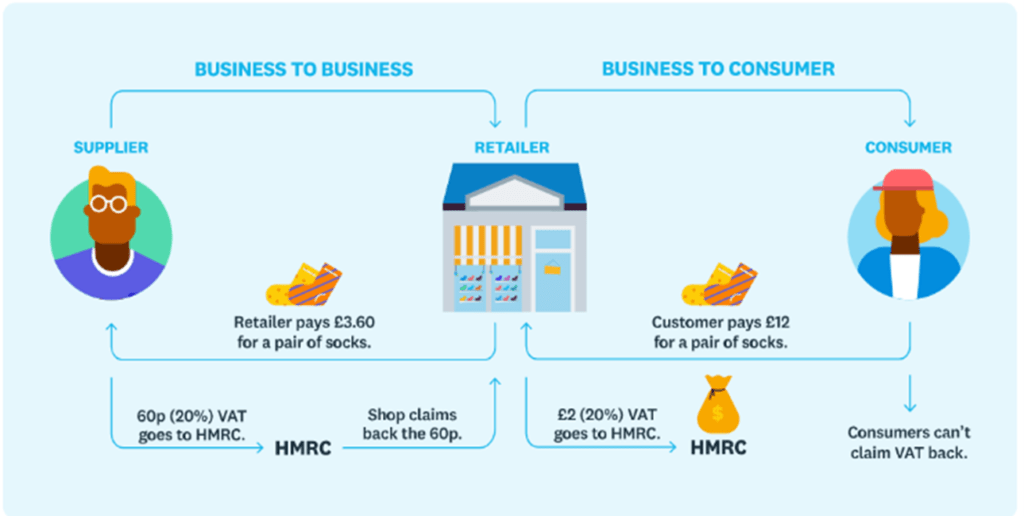

Value added tax is applicable to businesses with a turnover in excess of £90,000. If your business sells to other businesses (not the public) it is possible to register below this threshold.

VAT is added to every item you sell (at 20%).

When the buyer makes a purchase from a supplier this is called input tax and when a customer makes a purchase from a buyer this is known as output tax.

Businesses registered for VAT must submit (typically quarterly) to the HMRC details of VAT they’ve charged and paid. If they have paid more than charged HMRC will refund the difference otherwise they will need to pay what is owed. This submission has to be submitted digitally from within accounting software (our recommendation is Xero).

The standard VAT rate is 20% but some products and services are subject to lower rates or exempt/zero rated (for example water, most food or children’s cloths).

Please email to request our worksheet to help you decide if you should register for VAT.

HMRC offer a simplified process for businesses with a turnover below £150,000 known as the Flat Rate Scheme. Please ask FD Solutions and Accounting for further details.

Business Rates

You will need to pay business rates if you use any ‘non-domestic properties’ to run your business – this can include a home office.

Business rates are typically paid monthly with annual bill arriving in February or March of each year.

PAYE

If you have employees you are responsible for the PAYE tax (pay as you earn). This is an income tax which is deducted from salaries. These salaries include employees and your own (if your business is a company) and any other director.

You will need to register your business for PAYE with HMRC.

Income Tax rates and bands (frozen until 2028) are

| Band | Taxable Income | Tax Rate |

| Personal allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £150,000 | 40% |

| Additional rate | Over £150,000 | 45% |

If you pay employees monthly you must pay their deductions to HMRC by 22nd of the following tax month.

If you pay quarterly you must pay their deductions to HMRC by 22nd of the month following this quarter.

Payroll submissions must be made digitally from within accounting software (our recommendation is Xero).

If you are employing people please be aware of legislation regarding minimum wage, hours and legality to work.

Income Tax

Simply put – this is a tax on income. This is payable on any income earnt as a sole trader, director or partner.

In addition to salary this also covers –

-

- Self-employed profits

-

- State benefits

-

- Pensions

-

- Rental Income (above rent a room scheme)

-

- Trust income

-

- Income on savings (in excess of allowance)

You’ll need to pay your income tax with self assessment by 31st January.

National Insurance

You’ll need to pay National Insurance to qualify for a state pension as well as various government benefits.

Anybody aged over 16 must pay NIC if they are self-employed and making profits in excess of £12,570 or earning more than £241 per week.

National Insurance classes range from 1-4. The type of class you pay varies by employment status, income and whether or not you employ people.

| Employed | 2024-25 National Insurance |

| How much you earn | Class 1 Rate |

| Less than £12,570 | 0% |

| £12,570 – £50,270 | 12% |

| More than £50,270 | 2% |

| Self employed | |

| How much you earn | Class 2 and 4 rates |

| Less than £6,725 | 0% |

| £6,725 – £12,570 | £3.45 per week |

| £12,570 – £50,270 | 6.00% + £3.45 per week |

| More than £50,270 | 2.00% + £3.45 per week |

If you are self-employed there are different classes you may fall under

Self-employed: Sole traders must pay Class 2 and Class 4 NIC

Self-employed and employed: Limited company directors who are their own employees must pay Class 1 NICs

As a director you pay NICs through your own PAYE payroll and sole traders must include their contribution in their annual self-assessment.

Which tax type applies to my business?

Sole trader and Partnerships (including LLPs)

Sole traders pay Income Tax on any taxable profits. This is done on an annual basis as part of your self assessment.

For 2024/25 the tax free personal allowance is £12,570 meaning you will not pay income tax until you earn anything beyond that threshold.

Your tax rate also depends on your total annual profit and is distributed as follows –

Basic rate – 20% on profits between £12,571 and £50,270

Higher Rate – 40% between £50,271 and £150,000.

Additional Rate – 45% on profit in excess of £150,001

You must also pay NICs which is a Class 2 flat rate for any profits above £6,725 per annum together with 9% Class 4 if your profits are between £12,570 and £50,270.

Private Limited Company (including CICs)

All companies must pay Corporation Tax on any profits at 19% for the first £50,000 of profits.

There are certain reliefs which can reduce your bill – for example

Claiming research and development relief (R&D) or capital allowances for equipment purchases. For further details please speak to us.

Directors can also pay themselves a dividends (if the company has made a profit). For tax year 2024/25 the first £500 is tax free then – basic rate taxpayers pay 8.75% on dividends, higher rate-taxpayers 33.75% and additional-rate taxpayers 39.35%. There are often tax advantages to taking dividends in lieu of a salary – please ask our accountant for more details.

No comment yet, add your voice below!